This may be measured as:

- Sales

- Volume

- Margin

- Net-present-value

- Customized metric that makes sense for your business

I prefer ‘new margin’ or ‘new sales’ for growth-oriented companies.

If you have never prepared this type of chart, it might resemble an exaggerated example of the 80:20 rule where roughly 80% of the value comes from just 10%-20% of the projects. The low-end tail of the distribution could even contain a few projects with zero or even negative value. Think about that for a moment; these are active projects with support from at least one ‘champion’, where the company will lose money even if the project is 100% successful at meeting its goals. These projects and others in the low-end tail of the distribution should be the first candidates to be cut from the portfolio. There may be some low-value projects that you still pursue for strategic reasons, for example, to prove out a technology or to demonstrate credibility to an important customer, but these should be special cases, and should be evaluated with that long-term goal in mind.

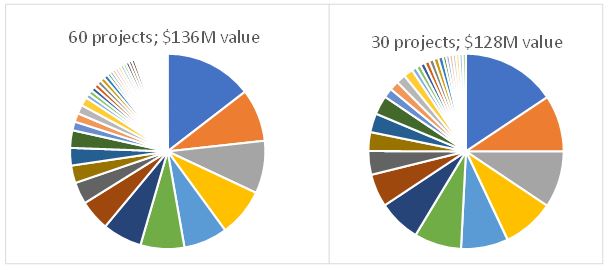

The pie charts below are fictional but resemble real examples that I have seen in many businesses. When you first start this exercise, it is possible that dropping even 50% of your smallest projects may have minimal effect on the combined value of the portfolio, but it will probably make large improvements in your speed and ability to focus on active projects.

Note that even after dropping the smallest 50% of projects, the chart still resembles an 80:20 plot. The idea is not to keep dropping the smallest projects, it is to balance the project size, probability of success, strategic fit, importance, etc, to arrive at the portfolio that fits your business objectives. This is consistent with the teachings of Cooper and Edgett, experts in the field of product innovation, that suggest that you need a balanced scorecard to perform an efficient portfolio review, and that scorecard must be dynamically adapted to meet the needs of your business.

When focusing your portfolio, and especially the ‘high-end’ projects that you will count on for your future, it’s important to critically analyze the data to ensure that the projections are realistic and that the projects all carry a consistent set of assumptions. In one recent case of which I am aware, a supposed top-value project never developed a coherent value proposition, so the high value assigned to it was merely a dream. When probed regarding why the customer would value the offering, it became clear that the project had no chance to succeed, so it was dropped and replaced with a better one.

After reviewing your portfolio, it’s likely that you will want to stop some projects, or at least put them on hold until stronger projects are completed. This is sure to draw the ire of the project champions who will have reasons why their pet project cannot be stopped. After all, they might involve great ideas and hard work. Hear out these project champions, but remember that in the end, you will need to balance available resources. As a previous boss of mine used to say, “We can’t do everything. We are saying NO to this group of projects, so we can say YES to the select few that will drive our future success.”